Seattle is on a divestment streak.

In February, the City Council voted unaminously to end the city’s $3 billion banking relationship with Wells Fargo, one of the funders of the Dakota Access pipeline. Then, in early April, the Council unanimously passed a resolution asserting that the next bank the city does business with can’t be a funder of the Keystone XL pipeline or other TransCanada projects, either. And on Tuesday, Mayor Ed Murray sent a letter to the Seattle City Employees’ Retirement System (SCERS) board recommending — firmly — that the board decide to move the city’s $2.5 billion pension fund out of fossil fuels, too.

“I want to be clear about where I stand on this issue,” Murray writes. Although he doesn’t have final decision-making authority on this (the SCERS board does), “Today I want to add my voice to the chorus of other advocates from 350.org and other organizations in calling for the Retirement Board to divest from fossil fuels.”

Specifically, Murray recommends that the board vote to divest immediately from coal, reevaluate its financial analyses with regard to fossil fuels, and allow the city’s Deferred Compensation Plan and Trust Committee to develop a fossil fuel-free investment portfolio option for employees.

“It’s pretty strong — we’re very pleased with the letter and the Mayor’s stance,” says 350 Seattle’s Alec Connon, who helped lead a pension-divestment campaign over the last six weeks or so. “He makes his position very clear. He even seems to try to identify himself as an advocate of the activists…Which is good!”

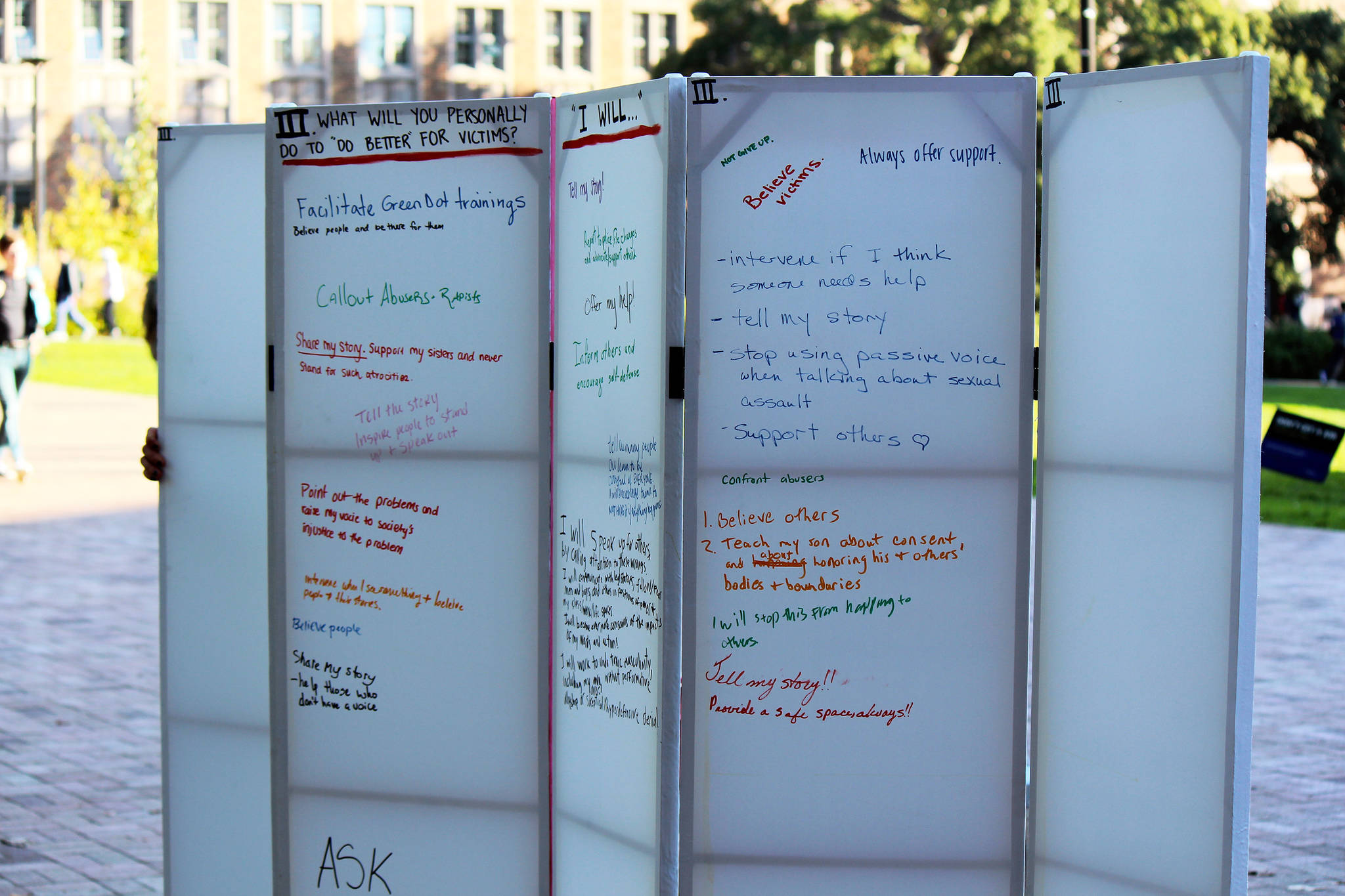

The campaign, begun in late February, included two separate visits of over 100 activists to the mayor’s office, a community letter signed by dozens of local groups that makes the financial, moral, and environmental argument for divestment, a report showing that not divesting has cost the city $65 million over the past decade, and a petition signed by approximately 500 city employees and retirees that calls for divestment, too.

“Over the last month, I’ve heard from many Seattleites who have asked about our city’s pension system, specifically whether the investments in the system adequately represent the values of City of Seattle employees,” Murray writes. “The advocates and employees I’ve heard from have made compelling arguments about the need to divest pension investments from fossil fuels, and our exposure to financial risks if we don’t do so. I believe these arguments have merit.”

Notably, President Donald Trump is mentioned twice in the letter; once for his efforts to scrap the Clean Power Plan and a second time for the things he has forgotten about renewable energy and racial equity. In Seattle, Murray says, those aren’t things we forget.

Mayor Letter to SCERS Board 4.11.17 by DanielPerson on Scribd

This isn’t the first time environmental activists have pressured the city to divest its pension funds from fossil fuels (a few years ago, others tried the “engaging in conversation, asking-nicely route,” Connon says), but the campaign this spring might have gotten the farthest. The financial argument is high up there.

“Divesting from fossil fuels is not only the right thing to do morally, it also makes financial sense,” said Dr. Bruce Flory, principal economist at Seattle Public Utilities, in a statement supporting the effort.

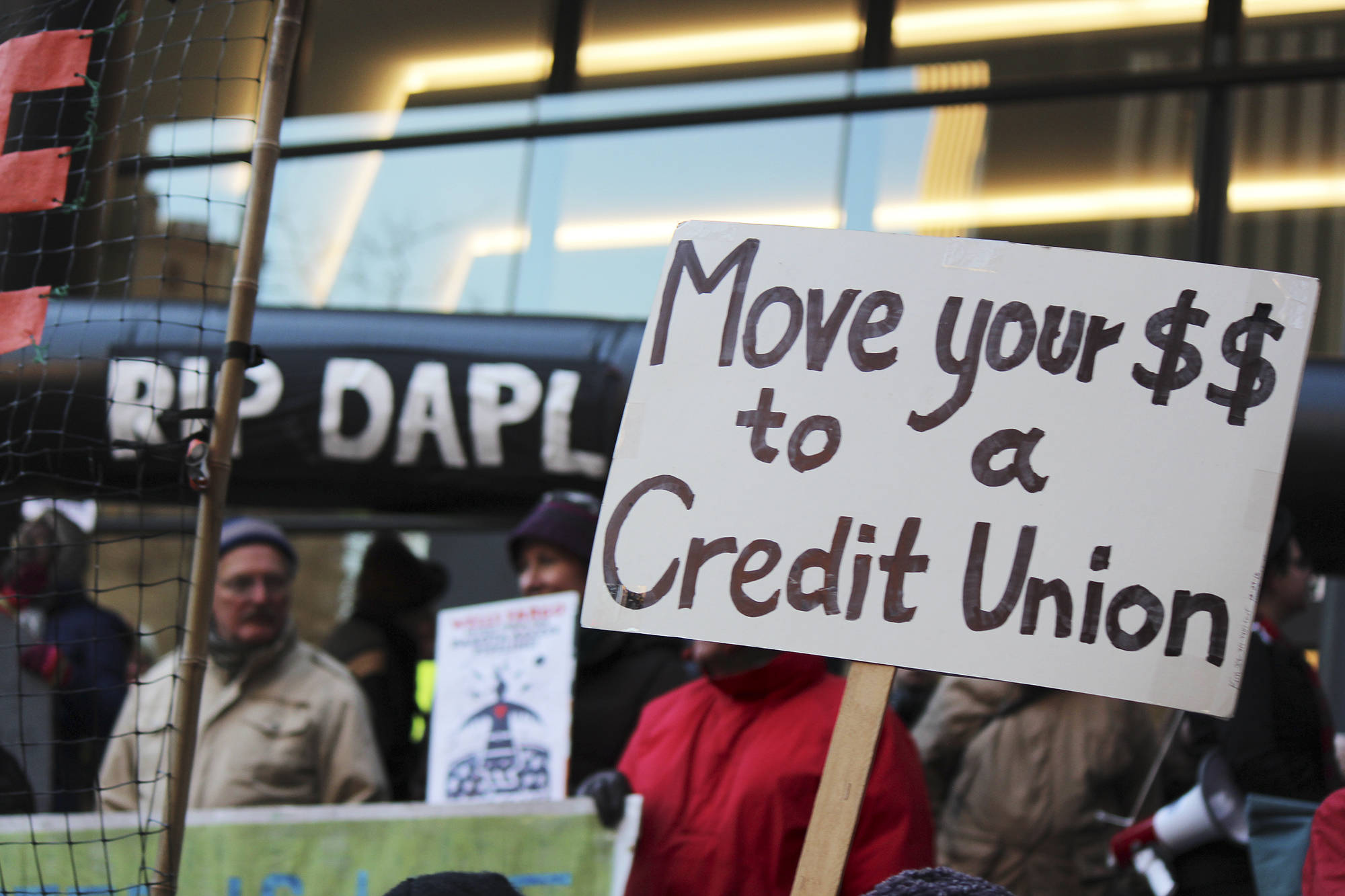

Though in late March the SCERS board did vote four to two against changing its investment practices, Connon says, there is another board meeting on Thursday morning at 9 a.m. Activists will be there, signs in hand. “We’re hopeful that the Mayor’s position and influence will convince the four board members that voted against it to reconsider,” Connon says. “We’re hopeful that this time, it will pass.”

sbernard@seattleweekly.com