Hidden Alpha is an investment analysis newsletter published online by Altimetry.

Chief Investment Strategist Joel Litman leads the newsletter. Joel and his team analyze markets, recommend stocks, and use their expertise to explain recent trends.

Is Hidden Alpha the right choice for you? Should you subscribe to Hidden Alpha? Why is the company warning you to do something before getting the vaccine? Find out everything you need to know about Hidden Alpha today in our review.

What is Hidden Alpha?

Hidden Alpha is an investment analysis newsletter published online by Altimetry.

Like other financial analysis newsletters, Hidden Alpha shares stock tips and market analysis with subscribers. Every month, subscribers receive new information about market trends along with specific stock recommendations. By investing in these stocks, you could make huge gains.

Hidden Alpha is led by investment analyst Joel Litman, who describes himself as “America’s top stock cop.” Joel claims he charges clients $100,000 per month for his research services (Altimetry is operated by Valens Research, which charges investors to access their research).

As part of a 2021 marketing campaign, Hidden Alpha is warning investors to take action before getting the vaccine. Joel Litman predicts investors can earn huge returns shortly by making specific moves today – and he wants to share those moves with investors.

Let’s take a closer look at what you’ll learn with Hidden Alpha – and why the company recommends taking specific action before getting the COVID-19 vaccine.

What Should You Do Before Getting the COVID-19 Vaccine?

In 2021, Hidden Alpha launched a new marketing campaign featuring the COVID-19 vaccine.

The campaign recommends taking specific action before you get the vaccine.

In the campaign, we learn about how Joel Litman predicted the March 2020 crash a month before it happened. We also know about how Joel predicted the rise of Square, AMD, and RingCentral.

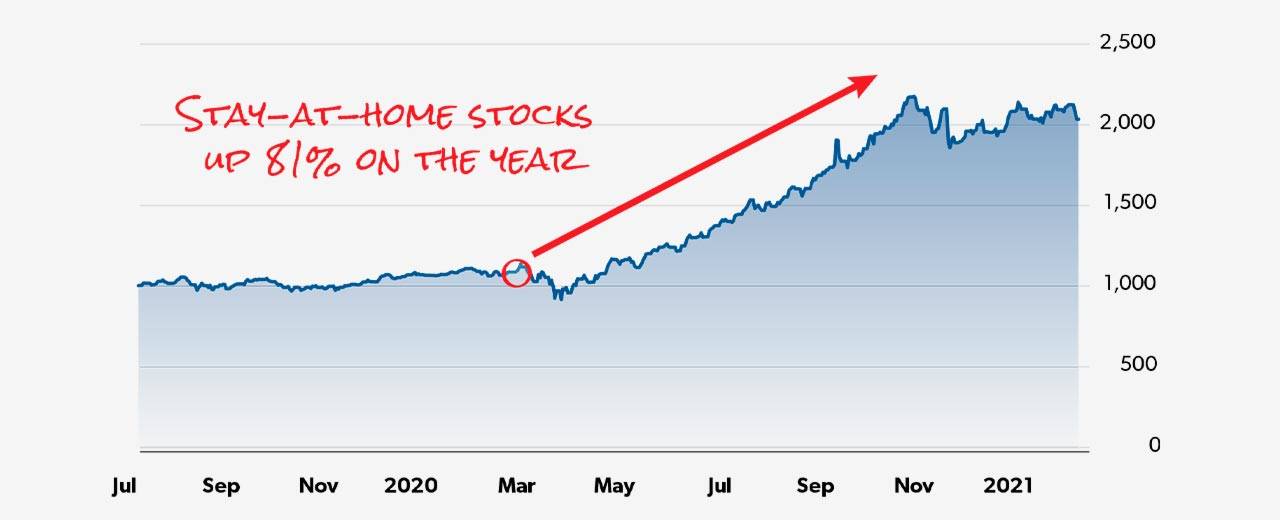

When the pandemic first stuck, investors, focused on “stay at home” stocks. Companies like Zoom and Peloton surged as people looked for ways to stay connected and active at home.

Now that we’re rolling out the vaccine, it’s time for investors to take a different approach. Joel Litman believes investors who take specific action today can avoid huge losses in the future:

“Many of these Covid darlings are in deep trouble. When a vaccine starts working – these stocks will drop like a rock. And unless you act quickly, they will drag your retirement account down with them.”

Joel claims hedge funds have over-bought companies like Zoom and other “stay at home” stocks. Hedge funds, pensions, 401ks, and other institutional investors have purchased way too many shares of these trendy stocks. Inevitably, when things return to normal, these stocks will plummet as firms exit their positions:

“That’s because I believe 401ks, mutual funds, pensions, and a large number of individual accounts on websites like Robinhood and Scottrade – are drastically overweight in these very stocks. Many of them have been the only place to find growth during the pandemic. And everyone piled in, driving these stocks up far beyond their valuations.”

As these tech companies plummet, we’ll experience a “vaccine crash.” That’s why investors need to protect themselves.

Hidden Alpha Warns About a Vaccine Crash

Joel claims we’ll face a vaccine crash shortly. One day, the rate of vaccinated people will reach a specific number, and the world will realize we can soon return to normal.

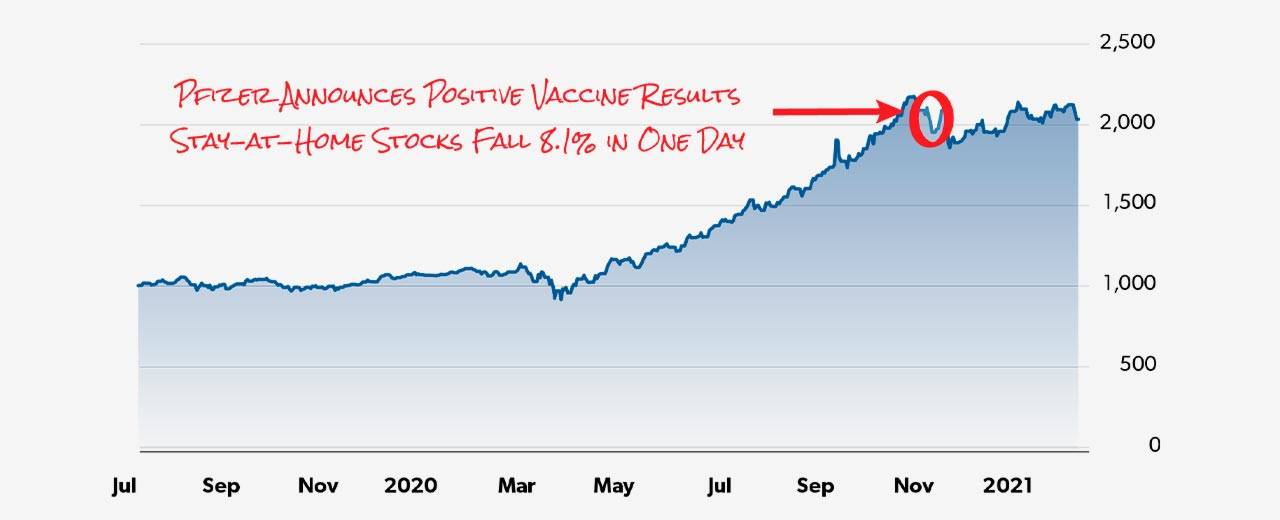

As Joel explains, we’ve seen signs of this vaccine crash already.

“Take a look at what these same companies did on November 9…That’s the day Pfizer announced the overwhelmingly successful results of its Covid-19 vaccine trials. These stocks plunged 8.1% – in one day. To put that in perspective, that is worse than the worst single day of the 2008 financial crisis.”

The overall stock market has only plunged more than 8.1% in one day in its entire 123-year history. That November 9 vaccine crash was the second-worst day in the history of the stock market.

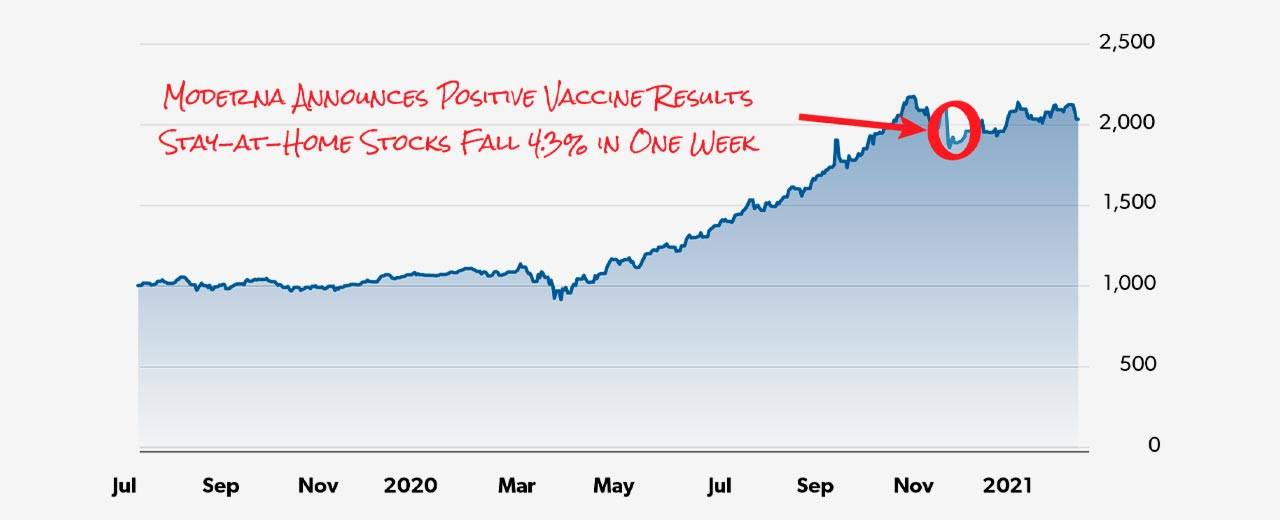

Then, something similar happened in the first week of December. Moderna announced positive results for its own vaccine. Stay-at-home stocks fell 4.3% in one week during this crash.

Overall, Joel believes the vaccine’s effect on the market “could be even worse than the virus itself.” When people return to work, many of these stays-at-home stocks will be revealed as “short-term fads.”

Ultimately, Joel’s goal is to get investors to sell individual companies as the vaccine continues to roll out. By selling respective trendy, overbought companies today, you can avoid a vaccine collapse in the future.

Hidden Alpha’s L.O.C.K. System

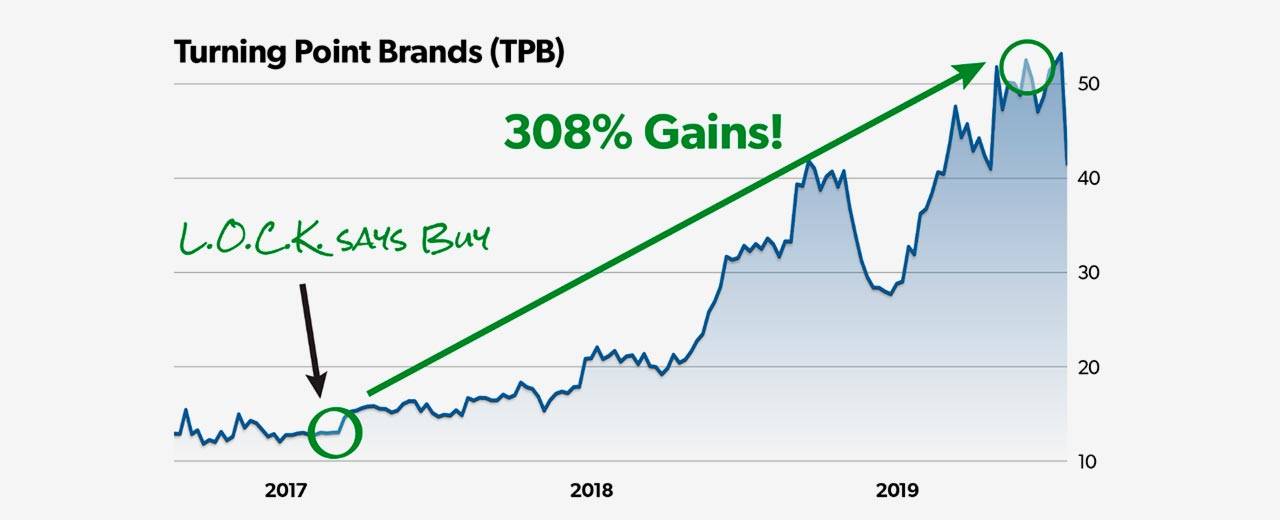

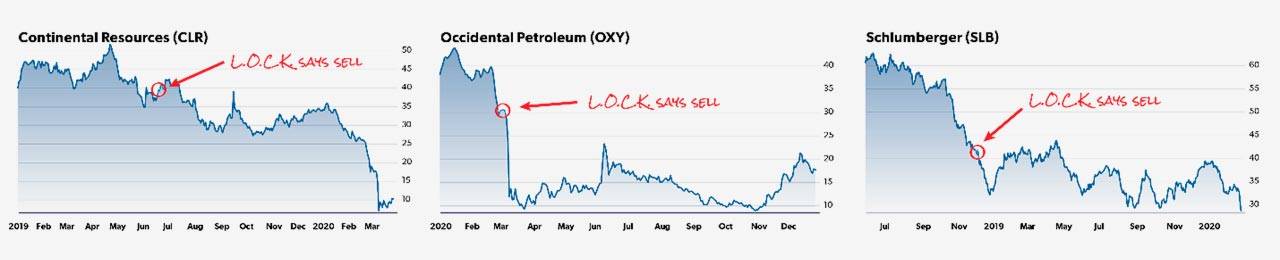

Joel analyzes stocks based on his L.O.C.K. system. This system separates winners from losers. It tells Joel which companies are fads doomed to fail – and which companies will stand the test of time.

The L.O.C.K. system uses countless factors to analyze winners and losers. The system even analyzes the pitch changes in a CEO’s voice during quarterly earnings calls, detecting whether a CEO is feigning confidence or hiding skepticism.

Joel’s L.O.C.K. system has warned of previous crashes. It warned investors about Alaska Airlines before the stock dropped, for example.

The L.O.C.K. system also warned investors about individual resource companies.

Now, Joel’s L.O.C.K. system is warning investors about individual trendy companies that rose to prominence during COVID. By subscribing to Hidden Alpha today, you can discover the names and ticker symbols of these companies to ensure you protect your portfolio before the vaccine crash.

3 Pandemic Habits that Will Never Return to Normal

The COVID-19 pandemic has changed countless parts of our life. Some of these habits – like partying with strangers in bars – will return to normal after the pandemic.

Other habits, however, will never return to normal.

Joel recommends investing in companies that have capitalized on “the new normal.” These companies are well-positioned to last long-term.

Other companies have capitalized on trends that will reverse when the pandemic ends. These companies have surged in value during the pandemic, but their rise may be over.

Joel believes three pandemic habits will never return to normal after the pandemic, including:

Enduring Habit #1: We Will Never Shop the Same Way Again: As many analysts have predicted, the COVID-19 pandemic has changed shopping forever. Whether it’s dining out, buying groceries, or making big-ticket purchases, we’re shopping online at a much higher rate than ever. Many people will continue buying groceries online after the pandemic ends. It’s convenient. Even tech-phobic people have been forced to adjust during the pandemic, and they’ve realized shopping online isn’t scary or difficult.

Enduring Habit #2: We Will Never Work the Same Way Again: The COVID-19 pandemic has irreversibly changed the way we work. Many employees have grown accustomed to working from home. Many employers are never switching back to their typical offices. We will never work the same way again.

Enduring Habit #3: We Will Not Watch Movies the Same Way Again: The pandemic has virtually killed shopping malls. Over 11,000 retail stores closed in 2020. Individual big-box retailers went bankrupt. Those who have failed to adapt to online shopping have faltered. Joel believes things like movie theaters will never go back to normal. It’s hard to convince people to spend $13 on a movie when they can pay $9 per month on a library of Netflix movies.

Because of these three enduring habits, Joel recommends buying:

- Online shopping companies and similar firms that make it easier to shop online

- Internet companies that provide crucial services for remote workers

- Home entertainment stocks for video games, movies, and more

- By buying these three types of stocks, investors can safeguard themselves from the end of the pandemic.

By subscribing to Hidden Alpha today, you can receive reports telling you exactly which stocks to buy and sell to prepare your portfolio for the vaccine crash.

What’s Included with Hidden Alpha?

As part of the 2021 promotion, Hidden Alpha bundles several bonus eBooks with all subscriptions.

Here’s what you get with each new subscription:

Monthly Issues of Hidden Alpha: Each month, subscribers receive a new Hidden alpha issue in their email inbox. You receive the case on the first Monday of every month. Each issue provides market analysis, stock recommendations, and Joel’s personal predictions for where markets will move next.

Research Report #1: The Giants of Online Shopping: This eBook lists the biggest online shopping companies expected to continue growing after the pandemic. Online shopping reached new heights during the pandemic, and The Giants of Online Shopping lists specific companies that Joel expects will continue rising long after the vaccine rolls out.

Research Report #2: The 3 Pillars of the Internet: This eBook lists specific companies you should buy to ensure you continue profiting from the work-from-home revolution. While some stocks have surged during the pandemic and are due for a correction, other stocks will continue to grow long-term because of permanent changes to our working habits.

Research Report #3: The 14 Fad Stocks to Sell Before You Get the Vaccine: This eBook lists specific stocks you should sell to protect yourself from an upcoming vaccine crash. The companies listed in this eBook have surged in popularity during the pandemic, but they’re likely to fall as things go back to normal.

Research Report #4: 3 High-Flying Home Entertainment Stocks to Buy Now: This report lists a video game stock that Joel expects will continue growing over the next few years. Video gaming was already a multi-billion dollar industry before the pandemic, and the pandemic pushed it to new heights. The report also mentions two movie stocks, including a streaming service and a home theater company, that Joel expects will skyrocket in popularity in the coming months.

Research Report #5: How to Be a Stock Cop: The Secrets of the L.O.C.K. System: Joel describes himself as “a stock cop” because he uses his L.O.C.K. system to analyze stocks. In this eBook, Joel explains how his L.O.C.K. system works, how to use his technique to analyze stocks, and how to do your due diligence even if you don’t have the resources of a much larger firm.

Access to Previous Reports: Subscribers receive access to all previous Hidden Alpha reports and guides, including all other research reports released by Joel Litman and his team in recent years.

Hidden Alpha Pricing

Hidden Alpha is priced at $49 per year for your first year, 75% off a regular subscription ($199 per year).

After your first year ends, your credit card will be charged $199 for your second year. Your credit card will continue to be charged $199 per year every year until you cancel. You can cancel your subscription at any time. You must cancel one day before your renewal date to avoid a renewal fee.

Hidden Alpha Refund Policy

A 30-day money-back guarantee backs hidden Alpha. You can request a complete refund within 30 days with no questions asked.

Contact the Hidden Alpha customer service team to receive a refund within 30 days of your original purchase.

About Altimetry

Altimetry is a financial analysis platform from Valens Research. The platform offers free blog posts and newsletters along with paid subscription services.

Popular Altimetry newsletters include High Alpha, Microcap Confidential, The Altimeter, and Hidden Alpha. These newsletters focus on identifying hot trends before they go mainstream, giving investors an advantage over the competition.

You can contact Altimetry via the following:

- Email Form: https://altimetry.com/contact

- Phone: (800) 701-9346

- Phone (International): (617) 229-6511

- Mailing Address: 110 Cambridge Street, Cambridge, MA 02141

Chief Investment Strategy Joel Litman leads altimetry. Other members of the team include Rob Spivey (Director of Research), Paolo Gutierrez (Chief Information Officer), and Sam Latter (Editor in Chief).

Who is Joel Litman?

Joel Litman is the Chief Investment Strategy for Altimetry. He’s also the president and CEO of Valens Research, a financial research firm used by 80% of Wall Street companies.

Joel has an extensive track record for teaching, consulting, and making media appearances. You can learn more about his professional track record here: https://altimetry.com/our-team/professor-joel-litman

Final Word

Altimetry is a financial analysis newsletter from Joel Litman and the Altimetry team. The newsletter aims to identify stocks that beat the market, giving investors highly-coveted “alpha” in their portfolio.

As part of a 2021 promotion, Hidden Alpha and Joel Litman have released a promotional page featuring a vaccine-related crash. As the world gradually returns to normal, we’ll see a vaccine crash.

Specific companies that rose to popularity during the pandemic will fall, while others will survive long-term. By subscribing to Hidden Alpha today, you get a collection of reports explaining the exact steps to take to avoid losses and maximize gains.

To learn more about Hidden Alpha, visit online today at Altimetry.com.