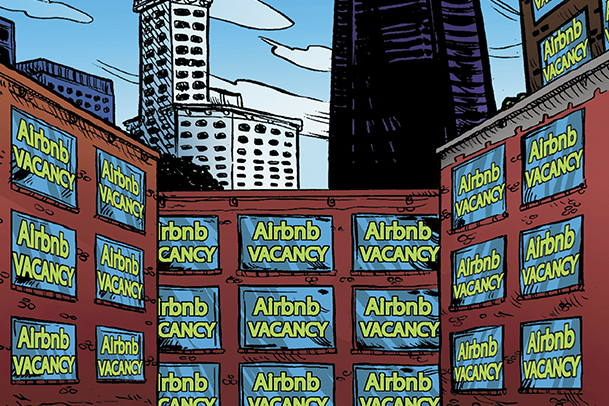

On Tuesday, City Councilmember Tim Burgess announced that he will introduce long anticipated legislation intended to regulate the operation of Airbnb, VRBO, and other short term residential rental sites in the city of Seattle, and roll back the conversion of residential rental units to Airbnb or VRBO short term rental units. Burgess hopes to regulate the growing short term rental market for reasons of consumer protection and out of the belief that Airbnb and other short term rental services are potential contributors to the housing affordability crisis. According to Burgess, around 600 rental units in the City of Seattle are subject to the expanded Airbnb regulation he plans to submit to the City Council.

I wrote a piece last August about Airbnb’s scope of operations in the city and looked into claims that the proliferation of Airbnb in Seattle has increased housing prices. In that piece, I quoted Peter Orser, a housing expert at the University of Washington, and a member of the state’s Affordable Housing Board, as saying then that Airbnb hasn’t drove up rents. He says the same thing now. According to Orser, the vacancy rate in Seattle is around 6 percent; a rental market under inflationary pressures would have roughly 3 percent vacancy. Orser says that the 600 units Burgess cited wouldn’t make a big enough dent in vacancy rates to make a significant inflationary impact on housing prices.

For its part, Airbnb claims that the company has not increased the amount of short term rentals in Seattle across all platforms—however, Airbnb is notoriously stingy with its data, and rarely releases information to the public or press. Third party websites like Insideairbnb document increases in the amount of Airbnb units available in the city, which seems to contradict the company’s claims. Burgess also said that Airbnb has touted high annual growth in its business the Seattle market going back to 2009.

Still, Burgess says that the current situation demands regulation, regardless of their affect on prices citywide. “I think those are significant numbers,” says Burgess. “Any time that 600 units are being removed form the long term rental market, that creates a legitimate issue that city government has an interest in.”

Part of the impetus for short term rental regulation comes from concerns that the short term rental market here might mirror the one in San Francisco; there, Airbnb rentals alone have eaten up a significant portion of the rental market and are likely driving up rents. Burgess thinks the same thing could happen here. Orser agrees that, if Seattle’s Airbnb share approached the crisis levels that now affect San Francisco, that further regulation is in order.

But Orser argues that, since the Airbnb phenomena in Seattle hasn’t reached that crisis level, the city shouldn’t implement new rules yet. “I appreciate the notion of proactivity, but I’d rather take the time to be thoughtful about creating a system that might actually work against the problem.”

Doubtless, Burgess would say that he’s done just that, but Orser has a point. Other cities that have tried to restrict or regulate the growth of Airbnb, such as San Francisco and Portland, have struggled to do so. According Michael Linfield, an official with the City of Portland, only around 15-20 percent of Airbnbs operating in Portland are registered under a program implemented in September 2014 that’s similar to the one proposed by Burgess.

“That equals a pretty dismal compliance rate almost two years after we adopted the program,” Linfield says.

Linfield says that intransigence on the part of Airbnb has kept compliance low. “We’ve asked repeatedly that [Airbnb] put in a field in their online form for hosts to fill out [City of Portland permits] up front and, if they don’t have that number, direct them to the [Portland] website to tell them how to get that number.” According to Linfield, Airbnb has claimed that they don’t have technical ability to implement the City of Portland’s requests—a claim that seems dubious, at best.

Indeed, pretty much everything about Airbnb’s impact on municipalities is murky, which is why every person I quoted—Burgess, Orser, and Linfield—had to guess at the company’s impact in their city. Every statistic and projection about the company, and its peers, isn’t publicly available.

After all, only the company itself knows the amount of units it really has in a given market, or how much they’re used. It’s proprietary information that Airbnb isn’t going to share unless it absolutely has to, and it has absolutely no incentive to give it out. The more Airbnb rents, the more fees it can collect. And it’s collecting lots of fees. In April, Airbnb’s total value was estimated to be above $25 billion, and it’s not going to give cities like Seattle and Portland any reason to keep that value from growing.